#Versus umbra unblocked mods#

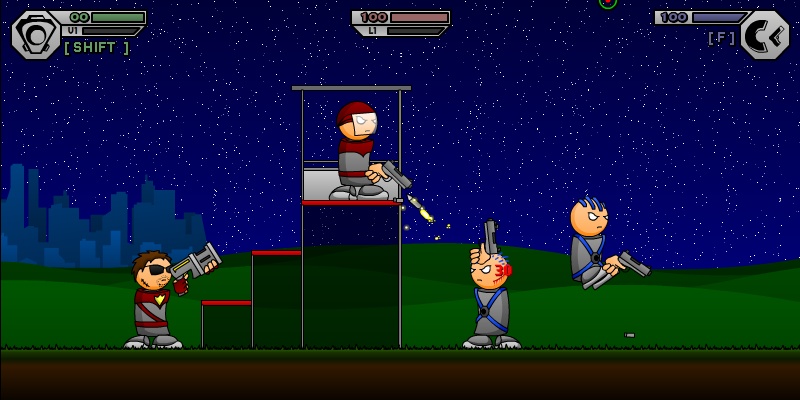

Thanks to the open source code, many interesting mods for the game have been released, which you can play on our website.

#Versus umbra unblocked android#

You can play the html5 version of Friday Night Funkin Unblocked in the browser on your Chromebook or download it on your iOS or Android device. After release in November 2020, the game immediately gained immense popularity among players around the world. A multilateral development bank may provide an additional layer of underwriting for developing countries, resulting in risk being shared among the investment bank(s), the multilateral organization, and the end investors.Friday Night Funkin (FNF) is an arcade game about music and street rap battles. After that, the syndicate would sell to a variety of investors. The bond would be covered by the bank, which would often lead a syndicate of brokers, some of whom would be based in other investment banks. Many governments used investment banks to organize the sales of sovereign bonds throughout the twentieth and early twenty-first centuries. When a government needs long-term funding, it frequently sells bonds on the stock exchange. credit automation The government on primary markets However, since around 1980, there has been an ongoing trend of disintermediation, in which major and creditworthy corporations have discovered that borrowing directly from capital markets rather than from banks results in them paying less interest.

Apart from share offerings, bank loans provided the majority of firm financing in the twentieth century. Two aspects favoring bank lending are that banks are more accessible to small and medium-sized businesses and that they have the power to create money while lending. These three distinctions all serve to limit the use of institutional lending as a source of capital. Third, bank depositors are more risk cautious than investors in the stock market. Second, versus capital market lending, bank lending is more strictly regulated. It does not take the form of resaleable security like a share or bond that can be traded on the markets). Standard bank loans are not secured to starters. Capital market versus bank loansĮven if the loans extend for more than a year, regular bank lending does not usually classify as a capital market transaction. It refers to a set of channels through which the public’s savings are made available to industrial and commercial firms and government agencies. Long-term finance is the focus of the capital market.

Money and capital markets, taken together, make up financial markets in the restricted sense of the term. The “capital markets,” on the other hand, are used to raise long-term funding, such as the purchase of stocks or bonds, or for loans that are not expected to be fully repaid for at least a year.ĪLSO READ 7 Moments That Basically Sum Up Your Rolex GMT Rose Gold watches Experience Money markets use to raise short-term funds, often for loans that are expected to be repaid as soon as the next day. The stock markets (for equity securities, also known as shares, where investors acquire ownership of corporations) and the bond markets provide a second important distinction (where investors become creditors). The existence of secondary markets encourages investors to participate in primary markets because they know they will be able to pay out their assets quickly if the need arises. Existing securities are sold and bought in the secondary market by investors or traders, frequently on an exchange, over-the-counter, or elsewhere. Pension funds, hedge funds, sovereign wealth funds, less typically affluent people, and investment banks dealing on their accounts are among the largest purchasers of bonds and stock. Firms usually issue both equity and bonds, but governments only issue bonds.

0 kommentar(er)

0 kommentar(er)